Introduction:

The cryptocurrency market is unique, with its decentralized nature, high volatility, and 24/7 trading. One of the essential components of this market is market makers. Market makers are responsible for providing liquidity, ensuring price stability, and improving market efficiency. In the crypto market, market makers play a crucial role in providing a fair and efficient trading environment for traders and investors.

In this article, we will explore the role of market makers in the crypto market and identify the leading market makers in the industry.

What are Market Makers?

Market makers are financial firms that play a vital role in maintaining liquidity in financial markets. These firms provide quotes for both buy and sell orders for a particular security, ensuring there is always a market for the security.

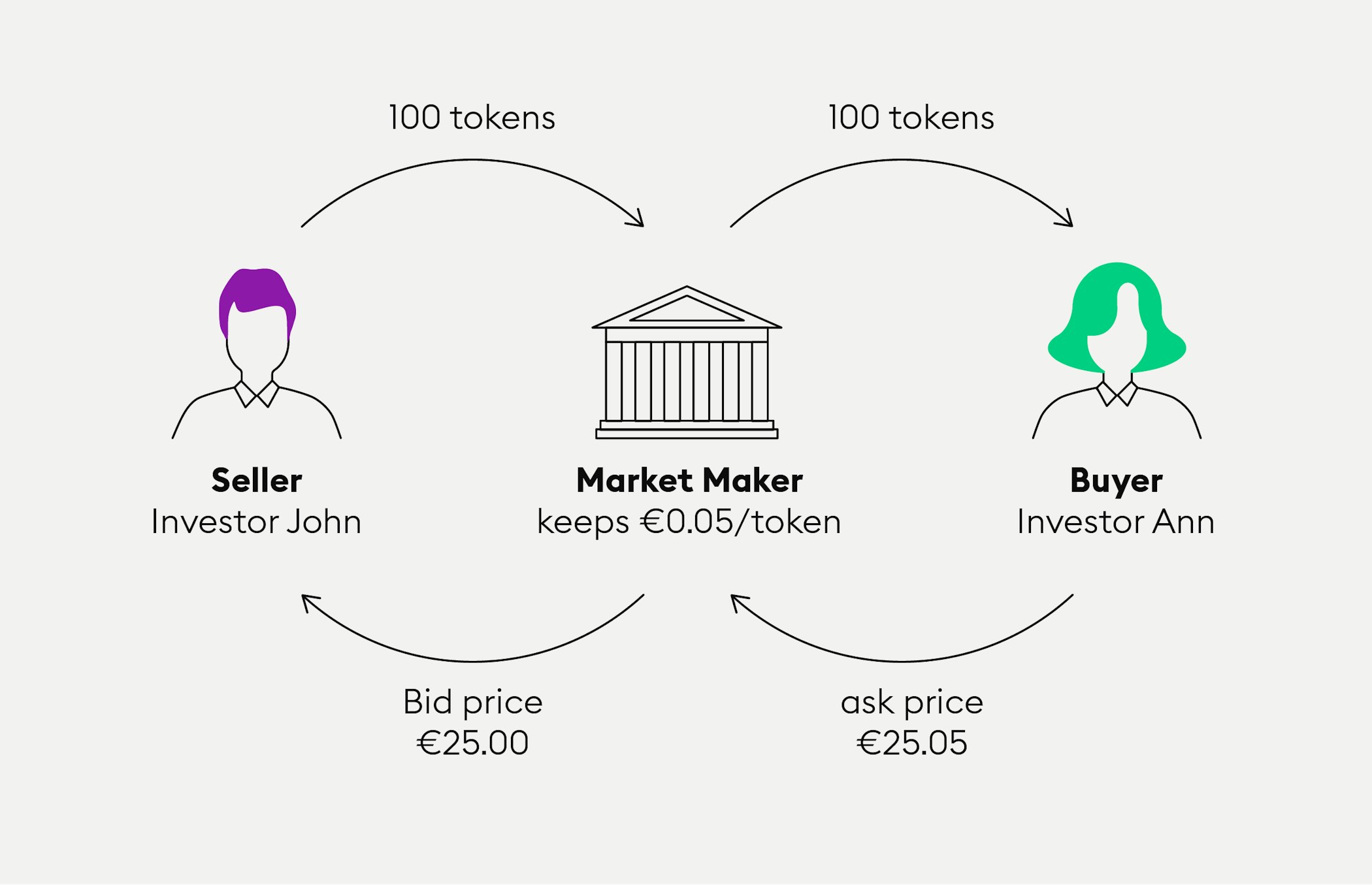

Market makers ensure that there is a balance between the supply and demand of securities by buying and selling the security. They profit by earning the bid-ask spread, which is the difference between the buy and sell price.

Market makers perform the same role in the cryptocurrency market. They provide liquidity to the market by offering buy and sell quotes for a particular cryptocurrency. They also facilitate the execution of trades by ensuring that there is always a market for the cryptocurrency.

Who are the Crypto Market Makers?

Jump Trading

Jump Trading is a Chicago-based trading firm that specializes in high-frequency trading. The company is one of the most prominent market makers in the crypto market, offering liquidity for a range of cryptocurrencies, including Bitcoin, Ethereum, and Litecoin.

Jump Trading is known for its innovative trading strategies, cutting-edge technology, and exceptional risk management. The company has a reputation for providing fair and efficient markets for its clients.

DRW Trading

DRW Trading is a Chicago-based trading firm that specializes in derivatives trading. The company is one of the largest market makers in the crypto market, offering liquidity for a range of cryptocurrencies, including Bitcoin, Ethereum, and Ripple.

DRW Trading is known for its high level of expertise in derivatives trading and risk management. The company has a reputation for providing deep liquidity and narrow spreads in the crypto market.

Jane Street

Jane Street is a New York-based trading firm that specializes in quantitative trading. The company is one of the largest market makers in the crypto market, offering liquidity for a range of cryptocurrencies, including Bitcoin, Ethereum, and Litecoin.

Jane Street is known for its sophisticated trading algorithms and exceptional risk management. The company has a reputation for providing fair and efficient markets for its clients.

Susquehanna International Group

Susquehanna International Group is a Philadelphia-based trading firm that specializes in derivatives trading. The company is one of the most prominent market makers in the crypto market, offering liquidity for a range of cryptocurrencies, including Bitcoin, Ethereum, and Ripple.

Susquehanna International Group is known for its expertise in options trading and exceptional risk management. The company has a reputation for providing deep liquidity and narrow spreads in the crypto market.

The cryptocurrency market has been rapidly growing and evolving over the past decade. With this growth, the role of market makers has become increasingly important. Market makers play a crucial role in providing liquidity to the market and facilitating trading activity. In this article, we will explore who the crypto market makers are, how they operate, and their significance in the cryptocurrency market.

Who are the crypto market makers?

Market makers are individuals or companies that facilitate the buying and selling of assets by providing liquidity to the market. In the context of cryptocurrencies, market makers are specialized traders who create a market for a particular cryptocurrency. They do this by offering to buy and sell the cryptocurrency at specific prices, thereby creating a market for it.

There are various market makers in the cryptocurrency market, including individuals, proprietary trading firms, and exchanges. Some of the biggest market makers in the crypto industry include Jump Trading, Susquehanna International Group, and Jane Street.

Is Binance a market maker?

Binance is a cryptocurrency exchange that provides a platform for trading various cryptocurrencies. While Binance is not primarily a market maker, it does offer market-making services to its users through its Binance Liquidity Swap program. This program allows users to trade cryptocurrencies at more competitive prices by offering access to a network of market makers.

How do crypto market makers make money?

Crypto market makers make money by profiting from the bid-ask spread. The bid-ask spread is the difference between the highest price a buyer is willing to pay for an asset and the lowest price a seller is willing to accept for that same asset. Market makers profit from this spread by buying the asset at the lower price and selling it at the higher price.

In addition to the bid-ask spread, market makers may also charge fees for their services. These fees may include commissions on trades, management fees, or other charges.

What is market making for crypto projects?

Market making for crypto projects refers to the process of creating a market for a new cryptocurrency. When a new cryptocurrency is launched, it may not have an established market or price. Market makers play a crucial role in creating a market for the new cryptocurrency by offering to buy and sell the cryptocurrency at specific prices. This creates liquidity for the cryptocurrency and helps to establish a market price.

Crypto market makers list:

As previously mentioned, some of the biggest market makers in the crypto industry include Jump Trading, Susquehanna International Group, and Jane Street. Other notable market makers include Alameda Research, Cumberland, and GSR.

Crypto market making strategy:

Market makers in the cryptocurrency market use a variety of strategies to provide liquidity to the market and profit from the bid-ask spread. One common strategy is to place limit orders at specific prices, thereby providing liquidity to the market and earning a profit from the bid-ask spread.

Another strategy is to use statistical analysis and algorithms to predict market trends and adjust prices accordingly. This allows market makers to adjust their prices quickly and effectively to changes in market conditions.

Crypto market making companies:

There are several companies that specialize in providing market-making services to the cryptocurrency market. These companies include GSR, Wintermute, and CoinRoutes, among others. These companies offer a range of services, including liquidity provision, algorithmic trading, and risk management.

Top crypto market makers 2022:

As the cryptocurrency market continues to grow and evolve, the role of market makers is becoming increasingly important. While it is difficult to predict the future, some of the top crypto market makers for 2022 may include established firms such as Jump Trading, Susquehanna International Group, and Jane Street, as well as newer companies such as Wintermute and CoinRoutes.

Crypto market makers reddit:

There are several subreddits dedicated to discussions about cryptocurrency market makers, including r/MarketMakers and r/C

here are some frequently asked questions about crypto market makers:

What is a crypto market maker?

A crypto market maker is a person or company that provides liquidity to a particular cryptocurrency market by buying and selling assets. They earn profits through the spread between the buy and sell prices.

How do crypto market makers make money?

Crypto market makers make money by buying assets at a lower price and selling them at a higher price. They earn profits by taking advantage of the bid-ask spread, which is the difference between the highest price a buyer is willing to pay and the lowest price a seller is willing to accept.

What is the role of a crypto market maker?

The primary role of a crypto market maker is to provide liquidity to the market. They ensure that buyers and sellers can easily buy and sell cryptocurrencies at a fair price.

Who are the biggest market makers in crypto?

The biggest market makers in crypto are usually large trading firms, such as Jump Trading, DRW, and Jane Street. However, there are also many smaller market makers that play an important role in the market.

How does market making work for crypto projects?

For crypto projects, market makers help to ensure that there is sufficient liquidity for their tokens. They may provide buy and sell orders on cryptocurrency exchanges to encourage trading and liquidity.

Is Binance a market maker?

Binance, one of the largest cryptocurrency exchanges, is not typically considered a market maker. However, they do offer liquidity on their exchange through their Binance Liquidity Pool.

What are some market making strategies used in crypto?

Some common market making strategies used in crypto include arbitrage, spread trading, and order book management. These strategies involve buying and selling assets at different prices to earn a profit.

What are some popular market making software used in crypto?

Some popular market making software used in crypto include Hummingbot, Kryll, and Coinrule. These software platforms allow traders to create and execute market making strategies automatically.

Conclusion:

Market makers play a crucial role in maintaining liquidity and market efficiency in the cryptocurrency market. They provide buy and sell quotes for a particular cryptocurrency, ensuring there is always a market for the cryptocurrency. Jump Trading, DRW Trading, Jane Street, and Susquehanna International Group are some of the most prominent market makers in the crypto market. These firms are known for their expertise in trading, innovative trading strategies, and exceptional risk management. As the crypto market continues to evolve, market makers will play an increasingly important role in providing a fair and efficient trading environment for traders and investors.